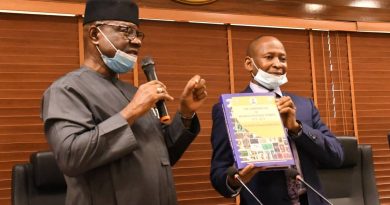

Innovations and Novelties cannot be overemphasized, says Bello as NDIC Hosts FICAN, ACAMB.

Oru Leonard

The Managing Director/ Chief Executive Officer, Nigeria Deposit Insurance Corporation (NDIC), Mr Hassan Bello has said that innovations and novelties cannot be overemphasized.

Bello said this on Monday in his address during the 19th edition of the workshop for Business Editors and Financial Correspondents Association of Nigeria ( FICAN) and the Association of Corporate Affairs Managers of Banks (ACAMB), at Port Harcourt.

He said that the reality of innovations and novelties has not only put a demand on regulators and supervisors in the financial sector across the world to enhance surveillance, but has also called for stronger collaborations, in order to deliver services that are laced with constantly improved values to the banking public and the society at large. “It is in line with the foregoing, that the Corporation has carefully chosen the theme of this year’s workshop as: “Boosting Depositors’ Confidence Amidst Emerging Issues and Challenges in the Banking System”, he stated.

The NDIC Boss who expressed gratitude noted that the workshop has evolved into the flagship capacity building and engagement platform by the Corporation, not only with the media, but with the members of the civil society groups and the ACAMB.

“This event has over the years, promoted better understanding of the Corporation’s roles in achieving financial system stability. It has also strengthened and broadened the media’s ability to interrogate and interpret topical issues in the financial services sector in general. In addition, the Corporation has been able to promote better understanding of its mandates and activities among members of the civil society organisations, thereby fostering collaboration in the area of enlightenment of the public on the benefits of the Deposit Insurance System (DIS). With the coming onboard of the Corporate Affairs Managers of Banks (ACAMB), I am optimistic, that the same high level of partnership, will be fostered towards educating bank depositors about the importance of the DIS through your consistence in the seminar”, he reiterated.

The MD/ CEO mentioned some bold steps taken and landmarks of the NDIC.

According to him “Over the time, we have embarked on series of strategic initiatives to achieve our desired vision.

Faster and orderly resolution of liquidated banks

“In the area of scaling-up the deposit insurance framework and ensuring faster and orderly resolutions of liquidated insured institutions, in May this year, with the active participation of the relevant stakeholders, we had

developed and deployed the Single Customer View (SCV) platform for the Microfinance and Primary Mortgage Banks in order to strengthen our processes and procedure for data collection. The platform would not only ensure availability of quality, timely and complete data to the NDIC, but would eliminate delays often experienced in reimbursing depositors following revocation of institutions’ licenses by the CBN.

“The final phase of the implementation of the SCV for Deposit Money Banks (DMBs) will be achieved through the incorporation of the SCV template as part of the on-going Integrated Regulatory Solution (IRS) jointly being developed with the CBN.

Consumer Protection

“In the area of consumer protection, the Corporation has strengthened its complaints resolution platforms, which include the Toll-Free Help Desk, social media handles and Complaints Desks in the Bank Examination, Special Insured Institutions and Claims Resolutions Departments, as well as our Zonal Offices, to receive and process complaints from depositors.

Deposit Guarantee

“As at June 30, 2022, the NDIC provided deposit insurance coverage to a total of 981 insured financial institutions. The breakdown includes: thirty-three (33) DMBs made up of Twenty-Four (24) Commercial Banks, Six (6) Merchant Banks and Three (3) Non-Interest Banks (NIBs) plus Two (2) Non-Interest Windows; 882 Microfinance Banks (MFBs); 34 Primary Mortgage Banks (PMBs); Three (3) Payment Service Banks (PSBs) and 29 Mobile Money Operators.

Bank Liquidation

“The NDIC bank liquidation mandate entails reimbursement of insured and uninsured depositors, creditors, and shareholders of banks in- liquidation. The liquidation activities, as at June 30, 2022, covered a total of 467 insured financial institutions in-liquidation, comprising of 49 DMBs, 367 MFBs, and 51 PMBs.

“As at June 2022, the NDIC had cumulatively paid ₦11.83 billion to over 443,949 insured depositors and over ₦101.37 billion to uninsured depositors of all categories of banks in-liquidation,

“It is most profound for me to say that, out of the 49 DMBs in-liquidation, the Corporation in September, 2022 declared 100 per cent liquidation dividend in 20 of those institutions, meaning that the Corporation has realized enough funds from their assets to fully pay all depositors of the listed banks.”

He noted that the above landmark achievements and others, would not have been possible, without the active support of the strategic stakeholders like the media.