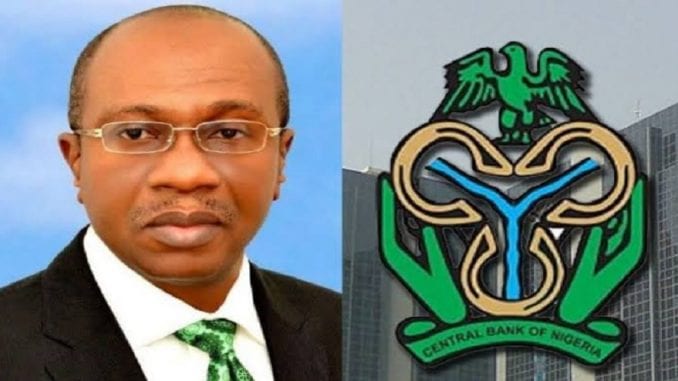

Nigerian Banks Still Strong Despite COVID-19 Impact – CBN Governor

The Governor of Central Bank of Nigeria (CBN), Mr Godwin Emefiele has said that the Nigerian banking industry is still resilient and strong to support the country’s economy

despite the ravages of the COVID-19 pandemic.

Mr Emefiele state this at the end of the Monetary Policy Committee (MPC) meeting in Abuja, on Tuesday, September 22, 2020 adding that the various interventionist activities of the apex bank helped to significantly mitigate the impact of the COVID-19 pandemic on businesses and households as well as reduce the level of contraction in the economy.

The CBN Governor said that the Nigerian economy grew at about 1.87 per cent in the first quarter of 2020. He however, noted that following the outbreak of the pandemic and subsequent devastation of the global economy, analysts projected the Nigerian economy to contrast by about 7.4 per cent in the second quarter.

The Gross Domestic Products (GDP), report published by the National Bureau of Statistics (NBS) early this month put the contraction at -6.1 per cent.

“The impact of the CBN interventionist activities has been positive, without which the positive GDP growth recorded in the first quarter of the year prior to the pandemic would not have been possible, neither would the somewhat reduced contraction of the economy to -6.1 per cent in the second quarter against projections of over -7.4 per cent have been possible,” Mr Emefiele explained.

On the back of the pandemic, the CBN governor said the apex bank decided to rebase the interest rates on all CBN intervention facilities from nine per cent to five per cent for one year to help people and businesses devastated by the crisis.

Revealing further details, he said, between N500,000 and N1.5 million was made available from about N100 billion targeted facility set aside for households and small and medium enterprises (SME), apart from an additional N100 billion provision for large companies in the healthcare and pharmaceutical sectors for research and procurement of drugs for the new coronavirus.

He said all the interventionist activities were part of the efforts by the CBN to find ways to reflate the economy to enable people who lost their jobs and companies not able to pay their workers’ salaries to come back to business and survive.

Banking industry performance

On the impact of the pandemic on non-performing loans in the books of the banks, the CBN governor said the banking industry regulator was proactive in its anticipation of the possible consequences on people and companies’ inability to earn revenue and pay workers’ salaries, as such would make it difficult for debtors to pay back their bank loans.

Consequently, Mr Emefiele said the MPC not only took a decision, supported by the CBN Board, to provide funding support for banks for businesses and households impacted by the pandemic, but also directed the banks to restructure the loans the people were unable to service under fresh terms.

He said how these interventions have affected the financial soundness of banks in the country despite the impact of the devastation of the COVID-19 on the global economy.

A review of the performance of the banking industry showed that capital adequacy ratio as of August has remained at 15.3 per cent since June 2019, while non-performing loans dropped from 9.4 per cent as at June 2019 to 6.1 per cent in August 2020.

Also, liquidity ratio, which stood at 48 per cent in June 2019, dropped to 36 per cent in August 2020, with an increase in credits over the last 13 months of injection of N3.7 trillion into the country’s economy. Return on equity of banks, which was about 24 per cent as at June 2019, dropped to 21 per cent in August 2020, and return on assets of banks, which was about 2.3 per cent in June 2019, stood at about 1.9 per cent in August 2020.

Similarly, the CBN governor said total deposits of banks have risen from N22.9 trillion in June 2019 to N28.9 trillion in August 2020; total loans have increased from N15.4 trillion in June 2019 to N19.33 trillion in August 2020 and total assets of the banks have also risen from N38 trillion in June 2019 to N48 trillion in August 2020.

“These are indications that the banking industry remains resilient and strong to support the growth of the Nigerian economy despite the COVID-19 pandemic,” the CBN governor said.

Impact of CBN intervention

Mr Emefiele noted that the COVID-19 pandemic, which triggered a global health crisis, quickly degenerated into a global economic crisis. He said interventions by the CBN, which include reduction of interest rates on interventionist programmes, restructuring of loans, and granting of targeted facilities to small businesses and households, significantly mitigated the impact of the crisis on the economy.

The CBN governor said out of the N100 bllion provided for targeted interventionist activities, about N78 billion has been disbursed to 130 beneficiaries, while about N44 billion out of the N100 billion set aside for the healthcare and pharmaceutical companies has been disbursed to 16 pharmaceutical firms and 25 hospitals.

Besides, out of the N1 trillion provided for the agricultural and manufacturing facilities, he said only N216 billion has so far been disbursed to 53 manufacturing companies, 12 agricultural-related companies, and 13 services projects, remaining almost N800billion yet to be accessed.

On the CBN agricultural SMEs fund, the CBN chief said about 144,600 beneficiaries have been given N54 billion for the acquisition of the real implements for their businesses, while the creative industry has received loans of about N2.9 billion for 250 young companies.

“The CBN has already disbursed a substantial sum of money, even with the funds not fully drawn by potential beneficiaries. There is still available funding at low-interest rates for all the people who plan to conduct businesses to get back to business as the government continues to increase the level of easing of lockdown,” he said.

On increased employment, Mr Emefiele said since 2015 the CBN has paid particular attention to reviving the agricultural sector through the Anchor Borrowers Programme, by making smallholder credits available to farmers on rice, tomato, maize, sorghum, cassava, and fish, resulting in an increase in agricultural credits from 1% to 4%.

He said loans to agro-services, which stood at about N324 billion in May 2019, has since gone up to N430 billion as at August 2020, while crop production, which was about N163 billion in May 2019, has also grown to about N294 billion August 2020. Cash crops, which was N90 billion in May 2019, has risen to N129 bilion. Other sectors which had N79 billion loans have today risen to N91 billion.

Credit: Premium Times