BANGLADESH STILL AMONG TOP SOURCING DESTINATIONS

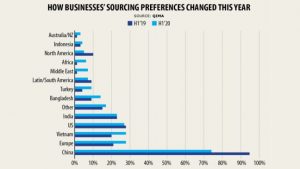

Bangladesh remains one of the top sourcing destinations after China for international clothing retailers and brands even during the coronavirus pandemic because of its competitive prices, according to a new report by leading supply chain compliance solutions provider QIMA.

After Vietnam, India and Bangladesh, alternative sourcing options of choice are still largely countries in Asia, including Taiwan, which enjoyed overwhelming preference as a sourcing market among US-based respondents.

The survey named “Evolution of Sourcing in 2020” was conducted in July 2020 by Hong Kong-based QIMA.

The survey named “Evolution of Sourcing in 2020” was conducted in July 2020 by Hong Kong-based QIMA.

It is said to be drawn on input from more than 200 businesses around the world across a variety of consumer product segments and built on previous QIMA research.

The report analyses the evolution of global sourcing in response to the ongoing Covid-19 pandemic, US-China trade tensions and other disruptions to global supply chains.

It says China is down, but not out.

The US and the EU brands are exploring sourcing options closer to home but are more likely to near-shore rather than re-shore.

For US-based companies, sourcing destinations closer to their home country continue to grow steadily, with the popularity of Latin and South America almost doubling compared with last year.

Although China still takes the crown for global sourcing, its dominance is noticeably less dramatic compared to previous years, especially in industries such as textile and apparel, where supplier portfolio diversification has been a priority for a while now, the QIMA report said.

While reliance on China has decreased across the board, it remains a top-priority sourcing region for promotional products while toy businesses were more likely to view Chinese suppliers as a priority, compared to 2019.

In addition to Vietnam, traditionally a footwear powerhouse, brands and retailers continued to view Bangladesh as an important sourcing market for footwear.

Textile and apparel businesses have continued diversifying their supplier portfolio, with an ever-lowering reliance on China and a more even distribution between overseas sourcing in Asia and near-shoring.

While near-shoring remains more popular than re-shoring, textile and apparel companies were more likely to buy from US and EU-based suppliers in 2020 compared to last year.

Outside of being a go-to sourcing market for textiles, India is increasingly viewed as an important sourcing region by buyers from different industries.

“Work orders are coming back gradually. The inflow of work orders is better in August than in June and July,” said Mohammad Abdus Salam, acting president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), over the phone.

But most of the work orders are leftover orders of April and May when the retailers and brands cancelled the work orders, he said.

Salam, however, said it was difficult to pinpoint what would happen in the near future because the rate of unemployment and inflation was increasing in the Western world. “So we are cautiously optimistic,” he said.

Between 1 and 22 August, garment export from Bangladesh increased 45.8 per cent year-on-year to $2.4 billion, according to data from BGMEA.

(Daily Star)