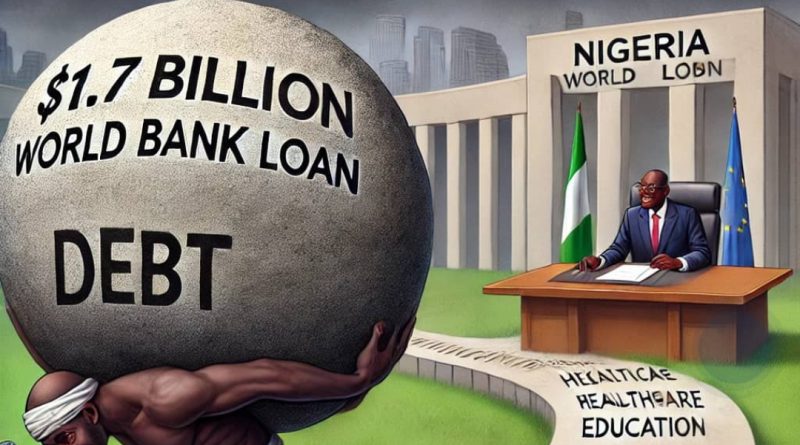

NIGERIA’S $1.7 BILLION LOAN: A Cycle of Debt or Path to Progress?

Perspectives with Dr. Iyke Ezeugo

As Nigeria continues to rack up billions in loans, President Bola Tinubu’s administration faces mounting scrutiny. The country’s latest $1.7 billion World Bank loan—part of a broader $6.65 billion borrowing campaign since May 2023—has raised serious questions about fiscal sustainability, transparency, and the efficacy of foreign debt as a tool for development. While loans have been earmarked for critical sectors like power generation, irrigation, healthcare, and education, it is increasingly clear that the nation’s borrowing habits might be more of a leaky bucket than a springboard for progress.

Nigeria’s Borrowing Odyssey: A Brief Overview

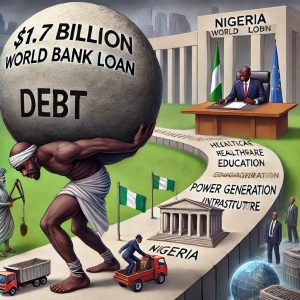

The $1.7 billion loan is slated for three key projects:

– $700 million for the Sustainable Power and Irrigation for Nigeria Project, aiming to improve electricity generation and support agricultural and industrial growth.

– $500 million for the Nigeria Human Capital Opportunities for Prosperity and Equity Governance Project, focused on improving education, healthcare, and social services.

– $500 million for the Nigeria Primary Healthcare Provision Strengthening Program, which seeks to bolster the country’s woefully inadequate healthcare infrastructure.

While these sectors are indeed vital to Nigeria’s long-term development, the incessant borrowing raises the specter of a nation bound by debt, borrowing more to maintain a semblance of growth while failing to address its underlying structural problems. This scenario evokes the myth of Sisyphus, condemned to roll a boulder up a hill for eternity—each loan might push the nation a bit forward, but only temporarily, as the debt burden inevitably rolls back down.

The Historical Context of Nigeria’s Debt Woes

Nigeria’s relationship with external debt is not a new phenomenon. The 1970s and 1980s saw the country ensnared in a debt trap, with its debt service ratio on export earnings soaring from 2.8% in 1980 to over 40% by 1985. The nation has consistently struggled to service its growing external debt, diverting valuable resources away from domestic priorities like healthcare and education. History seems to be repeating itself under Tinubu’s administration, as the current external debt situation threatens to derail economic progress once more.

In 2023, the country spent over 90% of its revenue on debt servicing, leaving precious little for essential services. The irony is glaring—while loans are meant to foster development, they are increasingly consuming resources meant for that very purpose. Nigeria’s borrowing resembles a Faustian bargain: immediate financial relief at the expense of future autonomy.

What Nigeria Borrowed Under Buhari

Nigeria’s debt crisis, particularly under President Muhammadu Buhari, reveals a troubling trajectory that has left the country in a precarious financial position. Between 2015 and 2023, under Buhari’s administration, Nigeria’s external debt ballooned significantly, contributing to the nation’s current fiscal woes.

When President Buhari took office in 2015, Nigeria’s external debt stood at $10.32 billion. By the end of his administration in 2023, that figure had soared to $41.69 billion—a staggering increase of over 300%. As claimed, the loans were intended to fund critical infrastructure projects, including the Second Niger Bridge, railway modernization, road construction, power generation, and agricultural programs.

Buhari’s government tried to justify these borrowings as necessary for economic revitalization, particularly in the face of dwindling oil revenues, which had historically been Nigeria’s primary source of income. The borrowed funds were directed towards projects such as:

– Lagos-Ibadan Railway: part of a broader plan to modernize the railway system.

– Zungeru Hydroelectric Power Project: aimed at increasing power generation.

– Second Niger Bridge: a key infrastructural project to improve connectivity in the southeastern region.

– Social Investment Programmes: including the N-Power initiative to reduce youth unemployment. Of course, some of these were done but not without a huge cost to the nation in unchecked upfront pilfering, bloated contracts, direct stealing in the N-Power initiative and hydra-headed repayment costs.

Overall, the efficiency and transparency of these investments have come under scrutiny. While some infrastructure projects were completed, many others suffered delays, mismanagement, and cost overruns. Moreover, the actual impact of these borrowings on improving the overall economic condition of Nigeria has been minimal. For instance, despite significant investments in power generation, the country continues to experience severe electricity shortages. Again, the youths empowerment and jobs created by N-Power now lives only in the imaginations of the project drivers that lined their personal bank accounts and cronies pockets with the N-Power monies using unverifiable names.

The Impact of Nigeria’s Growing Debt Burden

The sharp rise in external debt under Buhari’s administration put significant pressure on the country’s fiscal balance. By 2023, Nigeria was spending over 90% of its revenue on debt servicing—a situation described as a debt trap by financial experts. This ratio, which had been relatively low before 2015, skyrocketed due to the combination of aggressive borrowing and dwindling revenues, exacerbated by oil price shocks and economic mismanagement.

In the early years of Buhari’s tenure, the debt-to-GDP ratio remained below 25%, which was considered manageable. However, by 2023, this figure had increased to 39%, and the debt servicing-to-revenue ratio was unsustainable. This left little fiscal room for investments in critical sectors such as healthcare, education, and social services. Additionally, the ballooning debt increased Nigeria’s vulnerability to global economic shocks, as much of the borrowing was done in foreign currencies, leaving the country exposed to radical fluctuations in exchange rates. I guess many didn’t know that this was the reason for the untamed woeful depreciation of the Naira against all other currencies.

Reckless Borrowing: A National Irony

The reckless borrowing by successive governments stands in stark contrast to the strict regulations that apply to Nigerian citizens and civil servants regarding borrowing. Under Nigerian banking regulations, civil servants and private individuals are prohibited from borrowing more than 33% of their monthly income. This policy is anchored in prudential financial management, ensuring that citizens do not overextend themselves and fall into debt traps.

According to the Central Bank of Nigeria’s (CBN) Prudential Guidelines, banks are required to ensure that borrowers maintain a Debt Service-to-Income Ratio (DSR) of no more than *33%*. If a bank violates this cap by allowing a customer to borrow above the stipulated ratio, the bank can face significant penalties, including sanctions and regulatory action from the CBN. The rationale behind this cap is clear: it prevents individuals from overburdening themselves with debt, protecting them from financial distress.

The Irony in Government’s Approach

The irony here is glaring. While Nigerian citizens are subjected to stringent borrowing limits to prevent them from financial collapse, the Nigerian government itself continues to borrow recklessly, accumulating unsustainable debt levels. This discrepancy raises critical questions:

– Why is the same prudence not applied at the national level? If it is considered unwise for an individual to spend more than 33% of their income on debt servicing, how can it be justified that the Nigerian government spends over 90% of its revenue on debt servicing?

– Shouldn’t similar borrowing limits be imposed on governments? Just as banks are sanctioned for violating borrowing caps with their clients, there should be mechanisms in place to ensure that governments do not exceed responsible borrowing thresholds.

– Is the government borrowing for genuine economic benefit, or merely postponing a fiscal collapse? Given the inefficiencies in the execution of many projects funded by loans, the government’s borrowing behavior appears more reckless than strategic.

– Who eventually bears the burden of these loans: the government or the citizens? Now, the danger that the citizens averted, the government through careless leaders are bringing same upon them through the backdoors.

Why the National Debt Strategy Should Change

The current trajectory of borrowing without tangible returns is unsustainable. Nigeria’s rising debt profile not only undermines economic sovereignty but also jeopardizes future generations who will inherit the financial burden. A more stringent fiscal framework must be introduced to prevent reckless borrowing at the national level. This could include:

– Institutional borrowing caps, akin to those placed on individuals, limiting how much the government can borrow relative to its revenue.

– Stricter accountability measures to ensure that loans are used for projects that generate economic returns.

– Enhanced transparency in the management of borrowed funds to prevent the misallocation and corruption that has plagued previous projects.

Nigeria’s debt woes under Buhari and continuing under Tinubu highlight the critical need for a more disciplined and responsible approach to fiscal management. Borrowing can indeed be a tool for development, but only when done within sustainable limits and with clear accountability.

The Misalignment of Loan Priorities: Misplaced Focus?

Critics of Nigeria’s latest $1.7 billion loan argue that while power, healthcare, and education are important, these loans do not address the nation’s most urgent needs, such as *insecurity, creating jobs, boosting local industries, and enhancing agricultural productivity.* Power generation remains a key issue, yet despite previous loans dedicated to the sector, Nigeria still suffers from frequent blackouts and underdeveloped energy infrastructure.

Here, a parallel can be drawn to Icarus, whose desire for flight led him to the sun, resulting in his downfall. Nigeria’s desire to modernize and industrialize through borrowing is admirable, but without addressing core structural issues such as insecurity, corruption and mismanagement, the borrowed funds could melt away, just as Icarus’ wings did.

Corruption: The Leaky Bucket of Progress

The Achilles’ heel of Nigeria’s borrowing spree has always been corruption. Billions of dollars have been funneled into sectors like healthcare and education, with little to show for it. Hospitals remain underfunded and poorly equipped, government schools are overcrowded and understaffed, and power generation projects remain largely theoretical that many are either living in darkness because they either don’t have supplies or cannot afford the supplied power, or generating their own power. Misappropriation and bureaucratic inefficiencies have turned what could have been transformative projects into stalled or failed initiatives.

The tragic flaw in Nigeria’s development narrative is reminiscent of Shakespeare’s Hamlet, where indecision and internal rot lead to eventual ruin. Without addressing the systemic issues of corruption and inefficiency, the country is doomed to repeat its mistakes, no matter how many loans it secures.

Alternative Solutions: Breaking the Cycle of Debt

Rather than perpetually relying on foreign loans with stringent repayment terms, Nigeria should explore more sustainable and internally-driven sources of financing. For example, investment in large-scale farming and agro-processing industries could generate employment, reduce food insecurity, and earn foreign exchange from agricultural exports. Another low hanging fruit is immediate steps to block leakages in illegal mining and oil theft. Of course, these can’t be without tackling insecurity. This would address three of the nation’s most pressing issues: security, job creation and economic diversification for sustainable growth.

Moreover, the $700 million earmarked for the Sustainable Power and Irrigation Project could be more effectively channeled into renewable energy projects, such as solar solutions for rural communities. These projects require less extensive infrastructure and are scalable, offering more immediate benefits than the drawn-out power projects that have historically failed.

Domestic Resource Mobilization: The Forgotten Option

Nigeria has untapped domestic resources that could be mobilized for development without incurring foreign debt. Improved tax administration, the curbing of corruption, and the redirection of wasteful subsidies—such as the petrol subsidies removed in 2023—could free up significant government revenue. Furthermore, Nigeria’s Sovereign Wealth Fund (SWF) could be strategically employed to finance key development projects like power generation and healthcare reforms.

Drawing on the Antaeus myth, where the giant gains strength from contact with the earth, Nigeria, too, could regain its economic strength by staying grounded in its domestic potential rather than reaching out to foreign creditors.

Towards a Comprehensive Debt Management Strategy

Given Nigeria’s rising debt profile, it is imperative to develop a comprehensive debt management strategy. This strategy should focus on reducing the debt-to-GDP ratio, diversifying the country’s financing sources, and improving its debt repayment capacity. More importantly, the country must ensure that the loans it takes on are effectively utilized and transparently managed, to prevent further deepening of the debt trap.

Additionally, instead of simply accumulating debt, Nigeria should invest in industries that can generate revenue quickly, such as agriculture, renewable energy, and small- and medium-sized enterprises (SMEs). This approach would not only reduce the country’s reliance on foreign loans but also stimulate economic growth, create jobs, and improve the quality of life for ordinary Nigerians.

A New Path Forward

Nigeria’s current approach to borrowing is unsustainable and counterproductive. The country needs to break the cycle of dependency on foreign loans, which come with conditions that often limit its economic sovereignty. By focusing on domestic resource mobilization, investing in revenue-generating industries, and improving transparency in the use of public funds, Nigeria can achieve real economic growth without perpetuating its debt trap.

In the end, Nigeria’s development depends not on how much it borrows but on how wisely it uses its resources. The nation must heed the lessons of history and mythology alike: borrowing without foresight is like building a house on quicksand —no matter how grand the structure, it will eventually collapse.

Dr. Iyke Ezeugo is a Forensic Researcher, a Social Impact Expert, and Satirist who uses his perspectives and parodies to challenge the status quo, spark debates, and inspire fresh perspectives on public affairs through insightful intellectual injections.