NIGERIA TO EXIT RECESSION BY END OF 2020- CBN

……… as MPC retains MPR at 11.5%

The Central Bank of Nigeria (CBN), has projected that Nigeria will exit its current and worst recession in 33 years by the end of this year.

The apex bank made the projection at the end of its two-day Monetary Policy Committee (MPC) meeting, on Tuesday.

Despite rising inflation, the CBN also left its monetary policy rate (MPR) at 11.5 per cent, noting that it will be beneficial as it will allow current policy measures to permeate the economy while observing the trend of developments and that the heterodox policies of the Bank targeted at various sectors are showing positive results that would further engender growth.

It also retained other parameters such as asymmetric corridor of +100/-700 basis points around the MPR; credit reserve ratio (CRR) at 27.5 per cent; and liquidity ratio at 30 per cent.

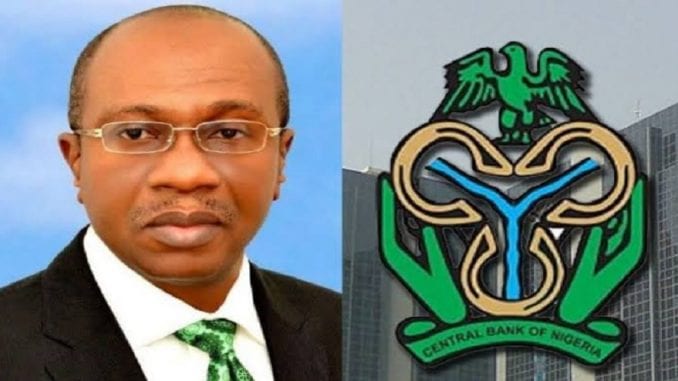

In a communique at the end of the meeting, CBN Governor, Mr Godwin Emefiele, said available data and forecasts for key macroeconomic variables suggest optimism in output growth in the fourth quarter of 2020, due to the positive outlook for most economic activities.

“Accordingly, the economy is expected to recover from the recession by the end of 2020, while inflation is projected to moderate by the first quarter of 2021.”

The 10 members of the committee that attended the last meeting for 2020 also expressed the hope that monetary and fiscal policies will continue their broad-based stimulus support towards full recovery as “this will involve fiscal measures to reduce unemployment, provide an enabling environment for private sector investment and necessary support to the health sector to cushion the impact of the coronavirus pandemic.

“In addition, the CBN is expected to sustain its various intervention measures to boost consumer spending and support the recovery.”

While recognising the supportive developmental roles of the CBN towards addressing some of the structural issues in the economy, “MPC specifically expressed optimism on the future impact of the disbursements from Agri-Business/Small and Medium Enterprise Investment Scheme (AGSMEIS) (N92.90 billion to 24,702 beneficiaries), Anchor Borrowers Program (ABP) by the sum of N164.91 billion to 954,279 beneficiaries and COVID-19 Targeted Credit Facility (TCF) to household and SMEs (N149.21 billion to 316,869 beneficiaries).”

The Committee noted the reduction in interest rates on loans granted by Deposit Money Banks (DMBs). As at October 2020, 86.23 per cent of total loans granted to over one (1) million customers, by Deposit Money Banks (DMBs) were at interest rates considerably below 20 per cent. This was an improvement from 76.43 per cent as of July 2019.

MPC noted the improvement in Financial Soundness Indicators of the DMBs which showed Capital Adequacy Ratio (CAR) of 15.5 per cent, Non-Performing Loans (NPLs) of 5.73 per cent and Liquidity Ratio (LR) of 35.6 per cent, as at October 2020.

As regards non-performing loans (NPLs), MPC however, noted that the ratio remained above the prudential benchmark of 5.0 per cent and urged the Bank to sustain its tight prudential regime to bring it below the benchmark.

The Committee observed the moderate decline in the external reserves position, which stood at US$35.18 billion as at November 19, 2020, compared with US$35.95 billion at end-September 2020, as crude oil prices continue to fluctuate with downward pressure.

(Daily Tracker)