MPC/CBN Reduction of Interest Rate To 13.5 Percent will stimulate Nigerian Economy-Emefiele

Oru Leonard

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria(CBN), has reduced the interest rate to 13.5 per cent.

The decision was taken at the meeting of the Monetary Policy Committee (MPC) of the apex bank in the country.

This is the first time since 2016, the Central Bank of Nigeria on Tuesday March 26, 2019 reduced the benchmark lending rate from 14 percent to 13.5 percent, a step it said would help stimulate economic growth.

The Monetary Policy Rate (MPR) which has been maintained at 14 percent since July 2016, was on Tuesday reduced to 13.5 percent after strong deliberations by the Committee.

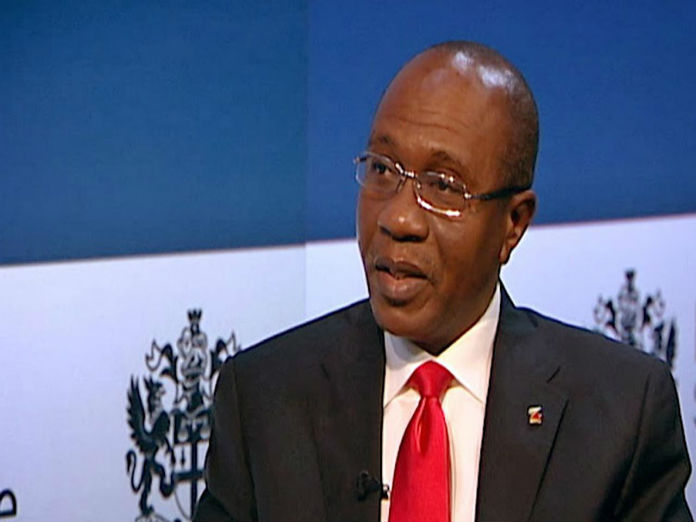

The Central Bank of Nigeria (CBN) Governor, Mr Godwin Emefiele, said this when he briefed newsmen in Abuja on the outcome of the 266th Monetary Policy Committee meeting.

The CBN governor said all 11 members of the committee were present at the meeting and six voted to reduce the Monetary Policy Rate (MPR) by 50 basis point.

He explained that two members voted to reduce the MPR by 25 basis point, another two members voted to hold the MPR at 14 per cent while one member voted to reduce it by 100 basis point.

He also said that 10 members voted to hold all other parameters at the present rate, while only one member voted to reduce the cash reserve ratio.

With this development, the Cash Reserves Ratio (CRR) remains unchanged at 22.5 per cent, liquidity at 30 per cent and Asymmetric corridor at +200 and -500 basis points around the MPR.

“The committee felt that given the relative stability in the key macroeconomic variables, there is a need to signal a new direction and in which case we are talking about being pro-growth.

“In its argument the committee was convinced that doing this would further uphold the bank’s commitment to promoting strong growth by way of encouraging credit flow to the productive sector of the economy.

“The MPC also felt that signaling through loosening by a marginal rate will serve to manage the sentiment in the capital flow market owing to a wider spread in yields in the emerging market and developing economies relative to the advanced economies. Moreover the real interest rate will still remain positive’’, he explained.

Emefiele noted that the forecasts of key macroeconomic variables indicated a positive outlook for the economy in 2019.

He said that the committee also harped on the need to debase the Gross Domestic Product (GDP) of the country, which was last carried out in 2010.

“The committee, however, expressed concern and sympathises with the fiscal authorities over the growing fiscal debt, fiscal deficit, external debt and debt servicing,” he added.