The Monetary Policy Committee (MPC), after meeting on the 21st and 22nd of November 2018, has retained the interest rate at 14 percent.

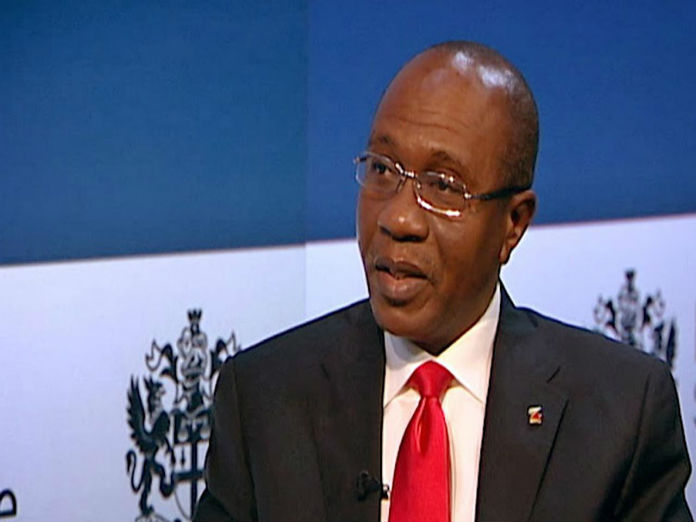

According to a statement made by available to the press by the Corporate Communication Department of the Central Bank of Nigeria (CBN), as was signed by the CBN Governor Mr Godwin Emefiele, the Committee appraised recent developments in the global and domestic macroeconomic and financial environments, as well as the economic outlook for the first half of 2019, before taking the decision to retain the interest rate at fourteen percent.

This trend he said was amidst a resurgence of global inflationary pressures, increased fragility in the global financial markets, weakening crude oil prices, continuous capital flow reversal and moderate currency depreciations, especially in the emerging markets as well as a strengthening US dollar and subdued global economic growth outlook.

The CBN Governor noted that the contraction in global output, underpinned largely by escalating trade tensions resulting in widespread uncertainty and waning investor confidence. Consequently, global growth in 2018 has been downgraded to 3.7 per cent from the earlier projection of 3.9 per cent. Growth softened in major advanced economies in the third quarter of 2018.

According to Mr Emefiele, in the Emerging Markets and Developing Economies (EMDEs), growth remained divergent, reflecting a combination of country-specific factors.

Thus, growth in the advanced economies is expected to remain at 2.4 per cent in 2018, supported by strong output growth in the US projected at 2.9 per cent. The U.S. expansionary fiscal stance, strong wage growth and continued inflow of capital into U.S. dollar denominated assets, are expected to provide the impetus for growth. In the United Kingdom, growth remained weak, hampered by uncertainties around Brexit negotiations. Growth in the Euro Area, projected at 2.0 per cent, appears to be subdued by low domestic aggregate demand amidst relatively high unemployment and reduced global trade.

On the MTN issue, he said that it is being resolved and there is no need for any body to worry. “There are several issues involved in the matter of the repatriation. It is better for you to be slow in taking some of these decisions but when you take them, you know that they are potent and that there is a rational for those decisions

“There is rational for the decision we took because we expected certain documents to be submitted, those documents have now been submitted we are in the process of saying these matters will be resolved.

“We have held meetings with the MTN group and I am optimistic that we are getting to the end of this issue and I repeat and I will continue to say so that the sanctity of the CCIs issued by our banks to foreign investors remains sacrosanct and no other company is being investigated on the issue of CCI, this is an isolated matter”, Emefiele said.

Speaking on election spending, he said that the Bank has had meetings with the Deposit Money Banks (DMB), and have warned them to be very careful and wary of money laundering issues.

“I believe they will be careful themselves because they have been told that if they are caught they will be heavily penalised”, he concluded.

The MPC Committee is made of eleven (11) members.