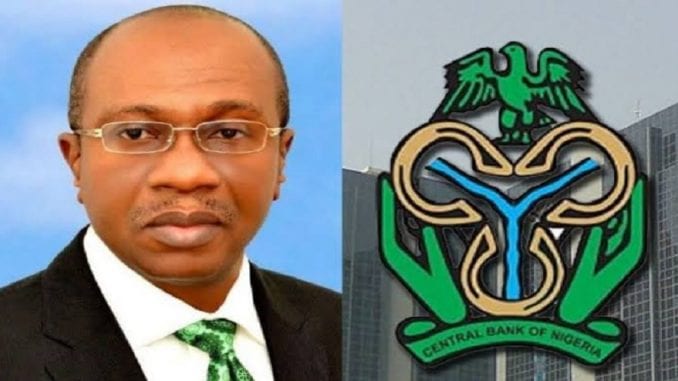

Matters of Urgent Attention: CBN Reacts, says NESG seeking for cheap popularity.

Oru Leonard

The Central Bank of Nigeria (CBN), has reacted to press release by the Nigerian Economic Summit Group (NESG), that some measures taken by the CBN to support the stability of our financial system to enable faster recovery of our economy, following the negative impact of the COVID-19 pandemic on Nigeria were ill motivated.

According the Director, Corporate Communications Department of the apex bank, Mr Isaac Okoroafor, the activities of CBN in stemming the Covid-19 pandemic were guided by strick economic viewpoint’s and global standards

Isaac noted that the impact of COVID-19 on countries across the world resulted in a significant downturn in the global economy. Consequently, countries including Nigeria were forced to impose lockdown measures in order to contain the spread of the pandemic.

“The Reserve Bank also provided credit facilities to non-bank institutions which included, money market funds and corporations. The balance sheet of the US Federal Reserve in support of these activities increased by over $3 trillion, while the European Central Bank expanded its balance sheet by over $1 trillion.

“Furthermore, the

Bank of England in an unusual move gave an open check to the UK Government in order

to fund its recovery efforts.

It is therefore pertinent to state that the Nigerian economy is not immune from these crises

given the over 65 percent drop in commodity prices; disruptions in global supply chains and the unprecedented outflow of over $100bn of debt and equity funds from emerging markets between March and May 2020; in addition to the impact of the lockdown on economic

activities. These activities resulted in an over 60 percent reduction in revenues due to the Federation Account, a significant drop in foreign currency inflows, which led to downward adjustments in the naira/dollar exchange rate and a rise in inflation due to the exchange rate pass through effect of imported inflation”, he said.

He explained that the Central Bank of Nigeria like other Central Banks across the world had to embark on extraordinary measures in order to stabilize the economy from an extraordinary shock.

“We took steps to increase the flow of credit to critical sectors of the economy, in order to enable faster recovery of the economy. We also sought to prevent the economic crisis from spilling into a major financial crisis by taking the following actions;

i. A 1-year extension of a moratorium on principal repayments for CBN

intervention facilities;

ii. Strengthening of the Loan to Deposit ratio policy, which has resulted in a significant rise in loans provided by financial institutions to banking customers.

Loans given to the private sector, have risen by over 21 percent over the past

year.

iii. Creation of NGN 50 billion target credit facility for affected households and small and medium enterprises through the NIRSAL Microfinance Bank;

iv. Creation of a NGN100 billion intervention fund in loans to pharmaceutical companies and healthcare practitioners intending to expand and strengthen the

capacity of our healthcare institutions;

v. Creation of a research fund, which is designed to support the development of

vaccines in Nigeria.

vi. N1 trillion facility in loans to boost local manufacturing and production across

critical sectors;

vii. Regulatory Forbearance was granted to banks to restructure loans given to

sectors that were severally affected by the pandemic

viii. Mobilization of key stakeholders in the Nigerian economy, which led to the

provision of over N23bn in relief materials to affected households, and the set up of 39 isolation centers across the country.

“The effect of these measures which included provision of palliatives to individuals affected by the pandemic, increase in access to credit to critical sectors of the economy that are either high employers of labor or have the ability to create jobs at a fast pace, helped to contain a significant decline in GDP growth in the 2nd quarter of the year. Analysts expected GDP growth to decline by 7.4 percent but the impact of the measures by the monetary and fiscal authorities helped to reduce this decline to 6.1 percent.

This decline was less severe

than the decline experienced in other economies such as the United States, South Africa,

and India which saw significant declines in growth by 32 percent, 52 percent and 23

percent respectively. We do expect that with the phase out of the lockdown measures,

GDP growth in the 3rd quarter will be much better than that of the 2nd quarter, due to the

impact of the measures being implemented by the Monetary and Fiscal Authorities”, the CBN stated

The CBN release berated NESG who it said could have raised its allegations directly with the CBN instead of choosing to release a Press Statement, having leaked its content to the media.

On the development finance activities CBN said, CBN said the smallholder farmers, households, and medium-scale entrepreneurs that benefited across the country know better. Adding that a total of N38.11 billion was disbursed as loans to 44,458 beneficiaries through the NIRSAL Microfinance Bank (NMFB). This number has risen to N59.12 billion; supporting to 103,189 beneficiaries as of August 2020.

“It is important for the NESG to note that our intervention programmes in the agricultural

sector were a key contributor to the resilience of the agricultural sector during the crisis, alluding to the fact that money cannot address constraints in the

agriculture sector, the NESG failed to realize that access to credit is listed among the three major challenges faced by farmers and businesses in Nigeria.

“As the sector experienced positive growth of 1.6 percent in the second quarter of the year despite the lockdown. As the NESG may be aware, as a result of the COVID-19 pandemic, Vietnam, Cambodia, India, and Thailand placed export restrictions on the exports of critical food items, including rice and eggs. With these disruptions, the Nigerian economy could have faced a major food crisis, but for the government’s intervention programmes in the agriculture sector.

” In the retail window, banks submit a detailed list of applicants who are then allocated foreign exchange based on availability. Given that these submissions are first scrutinized by the banks and are accompanied by the provision of significant documentation, we do not understand the extra transparency being called for by the NESG”, CBN expressed.

Stating further CBN said based on very limited information and cross-country exposure, the NESG refers to the CBN’s recent directive, which simply sets a floor on saving rates as “price fixing”. Given that in an ideal economic textbook/theory, saving should be equal to investment, we expected total deposits should closely mirror total loans. Yet, over the past several months, we have noticed an increasingly large gap between total deposits in the banking system and total credit to the economy. While total deposits stood at about N25 trillion in January 2020, total loans stood at N17 trillion. As of August 2020, while total deposits have increased to N29.7 trillion, total loans were only N19 trillion.

“Although the NESG, under its current leadership, has fallen short of its own standards and

become a shadow of its old self, we believe there are better ways to resuscitate the Group’s brand other than through cheap popularity and tarnished attention using ambushed press statements made up of contrived allegations. Given that the NESG should know better, we believe that these allegations are reflective of sinister motives and malicious intent”, CBN concluded.