Experts Warn of Tough Times Ahead for Nigeria’s Free Zones in Post-Covid19 Race for FDI

A group of international trade and investment experts have warned of tougher times ahead for Nigeria’s Free Zones in the race to attract more Foreign Direct Investment (FDI).

The alarm bell was sounded during a webinar organised Thursday by Dubai-based Free Zone training and management consulting company, CTP International FZLLE, to assess the state of readiness of Nigeria’s Free Zone community to compete in the post-Covid19 era.

With the theme, Attracting Increased FDI to Nigeria’s Free Zones in the Post-Covid19 Era, the webinar featured presentations from experts and practitioners drawn from various technical and backgrounds and geographical locations, including the United Kingdom, United States of America, India, Belgium, Nigeria and the United Arab Emirates.

In his opening remarks, Kachi Okezie, Principal Consultant at CTP International who moderated the discussion, explained that the purpose of the webinar was to examine the state of readiness of the Nigerian Free Zone sector to compete meaningfully in the increasingly crowded race to attract Foreign Direct Investment (FDI) to the country through the Free Zones. He said Nigeria could face up to the tough times enforced by the COVID19 pandemic with confidence, if the right support and strategy were employed to market the country’s Free Zones with great skill and expertise to an increasingly discerning global investor community. Okezie explained that these sorts of virtual conversations have already become a key feature of the post-COVID19 era and the sooner we all came to terms with it, the better for business it would be.

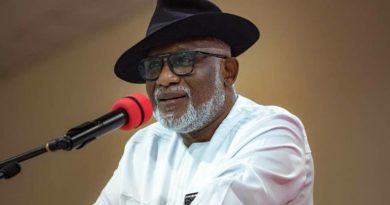

In his presentation titled “Seeking New Frontiers for Repositioning NEPZA for Maximum Investor Attraction and Retention in the Post Covid-19 Era”, Mr Bitrus Dawuk, Ag MD, Nigeria Export Processing Zones Authority, NEPZA gave an overview of his agency, highlighting some of the key action plans he had put in place to reposition the agency for maximum investor attraction and retention in post COVID-19 and Brexit era.

“Covid19 has presented both challenges and opportunities for Free Zones world-wide, challenged the manufacturing value addition of FZ enterprises and disrupted the global supply chain. However, the pandemic has also presented opportunities in the area of international trade and production as most manufacturers around the world are looking to diversify their supply chains, particularly, divesting from China, for obvious reasons”, the NEPZA boss said.

Dawuk announced that NEPZA had identified two major opportunities presented by Covid19: the first is in inward production, involving a change in sectorial focus in favour of agro-allied and healthcare, while the second is in the global and regional value and supply chain, involving manufacturing and supply of capital goods to other African countries.

He also identified some barriers faced by the agency in attracting and retaining investors, and how these are being addressed. These include the “periodic interference of other government agencies in FZ operations; overly stringent or impromptu government policies (fiscal and monetary) and an outdated legal framework (over twenty years old), which makes it difficult to attract required private sector investment.”

He further highlighted the prolonged state of insecurity in the country, infrastructure deficit and issues around the Rules of Origin under the African Continental Free Trade Agreement (AFCFTA) which impacts adversely on Free Zone products as additional challenges which must be overcome.

Contributing, Dr Antony Laurent, UK-based international trade and investment expert and entrepreneur opined that both Covid19 and Brexit appear to have caught Nigeria off-guard and unprepared. He said that while many Commonwealth countries like India, Pakistan, Australia and South Africa had concluded deal terms with Britain as early as 2015 such that in the event that Brexit does happen, trade deals would be tied up quickly. Nigeria does not appear to have done so.

Laurent lamented that unlike other major crude oil exporters like Saudi Arabia, UAE, Norway and Mexico, Nigeria and Venezuela have yet to successfully diversify their economies away from oil, hence the heavy impact of the shock as the market collapsed due to the global pandemic and lockdown. “Nigeria, however, from all indicators, is quite resilient, with lots of opportunities, not least through the Free Zones. NEPZA should target all multinational companies in Nigeria and entice them to create wholly-owned subsidiaries to be located within the Free Zones which they can use to service and stabilise their supply chains.”

Concluding, Dr Laurent advised Nigerian Free Zones to “sell themselves on the proposition that they are on the doorstep of an enormous and growing marketplace, the proximity of an abundance of natural resources and a plentiful supply of an educated and entrepreneurial and youthful population.”

In his contributing to the discourse, Prof Ken Ife, UK-based consultant to the Central Bank of Nigeria on policy advocacy and lead consultant to the ECOWAS Commission on private sector development and trade policy, identified poor infrastructure, a suffocating business environment and insecurity as the three main barriers to Nigeria’s quest for increased FDI into the Free Zones. He said: “Investors have no sentiment beyond where they can make the most money and enjoy maximum security for their investment. Things like power supply, water, road and rail are increasingly considered “hygiene factors” and investors want to invest in ready-built and serviced industrial parks presented in a plug-and-play mode, so they can concentrate on running their core business.”

He concluded that “Despite the enormous odds, Nigeria has a fantastic window of opportunity to cash in and attract record FDI, provided the right actions are taken, such as changing the negotiation paradigm when dealing with potential investors from desperate to confident, and understanding Nigeria’s Unique Selling Points (USP) and her strategic and comparative advantage.”

Also speaking was Washington DC-based international attorney, arbitrator and former World Bank senior counsel, Dr Uche Onwuamaegbu. The legal luminary asserted that “Having effective and credible dispute resolution mechanism is critical to the investor’s decision as to where to invest, because it translates to lower cost of risk insurance cover.”

He added, “Investors follow the money generally, and as the stakes get higher the prospect of large returns alone will not be enough to attract or retain them. Investors need the assurance that they can enforce their legal rights if the need arises, as such no investor wants to invest in a country where settlement of commercial disputes is at the mercy of local courts, which are usually sluggish, time-consuming are costly.”

In conclusion, Dr Onwuamaegbu recommends that “Free Zones need a robust dispute settlement system, designed bearing in mind possible conflicts with existing local laws and international treaty obligations. Covid19 provides an opportunity to reflect and create the necessary infrastructure for effective dispute resolution for the Free Zone sector in Nigeria.”

Also speaking, Mr Sushil Sharma, India-based, global business strategy consultant and best-selling author asserted that the Free Zone concept is here to stay and is essentially about “ring-fencing your export-oriented industries from local taxes and levies with the goal of increasing their international competitiveness.” He revealed that China currently leads the world in the number of Free Zones. “For context, as at 2019, of all the countries of the world, China had the most Free Zones with 2,543 followed by Philippines with 528, India with 373 and Turkey with 102. The UAE has 47 while Nigeria has 36 (licensed).”

Citing three case studies to buttress, Sharma argued that experience has shown that whilst policy can support competency, and competency creates competitiveness, policy does not necessarily create competitiveness. Therefore, he submits, “Just as India did with ICT and diamond processing, Nigeria should first identify a handful of key competencies in which it has comparative advantage and then build the Free Zone strategy and policy around these.”

Also contributing, “Dr Badewa Adejugbe-Williams, coordinator of Nigeria Diaspora Investment Summit (NDIS) underscored the strategic role Nigerians in Diaspora have been playing and could still play in the drive to attract FDI to the country.

“The Nigerian Diaspora can play a key role in attracting Foreign Direct Investment (FDI) to the country’s Free Zones, particularly in the post-Covid19 era. Beyond remittances (valued at $25.6billion in 2018), Nigerians in Diaspora can help in marketing the vast untapped opportunities in the country to foreign investors, particularly those they have come to know on a personal level”, she said.

Adejugbe-Williams, noted that despite the challenges, Nigeria has a lot to propel it towards economic survival and growth, but not without exploiting her strengths, particularly the Diaspora.

She concluded that “Covid19 presents an opportunity to make necessary changes; reset the system, utilise our Diaspora as a major strength and key resource, involving them, giving them an active role and cleaning up the politics to make it corruption-free and attractive both to top Diaspora talent and investors.”

In his presentation, the last for the day, Dubai-based international business and management consultant, Swapnesh Sebastian, highlighted the need to embrace and mainstream technology as the post-Covid19 new culture and new normal. He posited that to be competitive, Nigeria’s Free Zones must be well supported not just with the latest ICT infrastructure and systems including virtual Free Zones and serviced offices, but also well trained staff to operate them.

Sebastian concluded that “Any economy that is not totally ICT-driven is doomed; that 5G is the new fuel powering modern economies via Artificial Intelligence (AI) and that data is the new language and those who can’t speak it won’t be heard and can’t do business.”