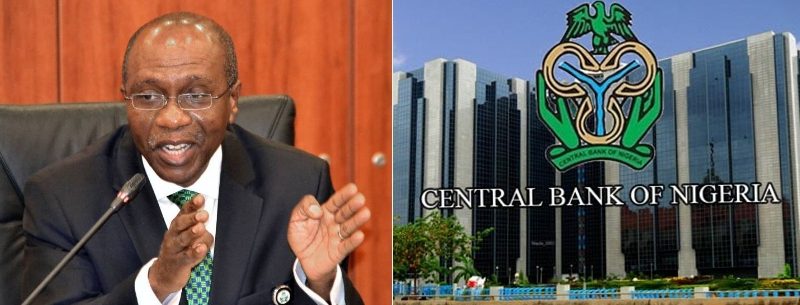

100 FOR 100 PPP: CBN Disburses N23.2 Billion To 28 Maiden Beneficiaries

…..Says program is designed by CBN to boost production and productivity.

Oru Leonard

The Governor, Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, has formally launched the 100 for 100 policy on Production and Productivity (PPP),with the presentation of commemorative cheques worth N23.2 Billion to 28 beneficiaries, through seven Participating Financial Institutions (PFIs).

Presenting the cheques to the beneficiaries, which comprised 14 companies in the manufacturing sector, 12 in the agricultural sector, and two in the healthcare sector, at the Bank’s head office, Mr. Emefiele disclosed that the 100 for 100 PPP was designed by the CBN to stimulate investments in Nigeria’s priority sectors with the core objective of boosting production and productivity. He added that these will aid Nigeria’s efforts to stimulate greater growth of the economy and create employment opportunities.

According to him, the formal launch of the 100 for 100 policy for the Scheme’s developmental component underscored the critical roles in building new blocks for economic growth, improving production expansion, reducing reliance on imports and fostering growth on non-oil export, particularly as the country’s national growth was highly dependent on a strong and competitive businesses.

He explained that, “under the initiative, every hundred days, manufacturers in critical sectors that seek to engage in greenfield projects or in expanding their existing facilities will have access to cheaper forms of credit at single digit rates, as well as foreign exchange to procure plants and machineries.”

While noting that the programme had the potential to significantly accelerate manufacturing output, promote further diversification of the economy and enable faster growth of Nigeria’s non-oil exports, Emefiele expressed confidence that the PPP will help to reduce the country’s over-reliance on imports, and stimulate productivity in agriculture, healthcare, manufacturing, extractive industries, logistics services, trade-related infrastructure, and renewable energy.

Specifically, he said the scheme aimed at creating more than 20,000 jobs and expected to generate over US$125.80 million in foreign exchange earnings.

Speaking further, he explained that only 79 out of an initial 243 applications valued at N321.06 billion spread across key sectors of the economy, were submitted by the banks, out of which only 28 companies with projects that had clearly articulated proposals were eventually selected for funding valued at N23.20 billion.

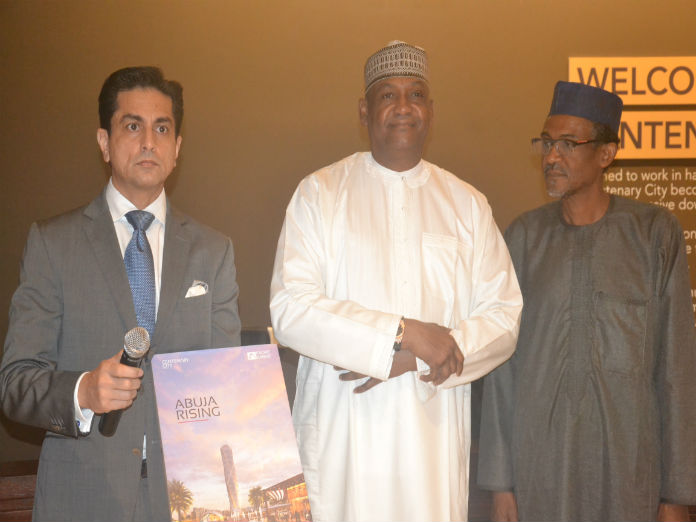

Also speaking at the launch, the Minister of Labour and Employment, Dr. Chris Ngige lauded the CBN Governor for what he described as laudable initiatives, which he said aligned with the Federal Government’s goal of creating jobs and lifting people out of poverty.

While noting that the Nigerian economy was yet to be fully diversified, Dr. Ngige sued for greater collaboration between the fiscal and monetary authorities, noting that such partnership was vital to ensuring economic growth.

Speaking on behalf of the Secretary to the Government of the Federation (SGF), Mr. Boss Mustapha, the Permanent Secretary, Ecological Fund Office, Dr, Habiba Lawal said the ingenious initiative was coming at a time the country was exploring means of economic diversification aimed at reversing its overdependence on importation as well as galvanizing local production of goods and services that would trigger employment generation, wealth creation and poverty eradication.

In their separate remarks, the President, Manufactures Association of Nigeria (MAN), Dr. Mansur Ahmed and the Managing Director, Access Bank Plc, Dr. Herbert Wigwe, who doubles as the Chairman, Body of Bank Chief Executive Officers (CEOS), commended the initiative and pledged their readiness to collaborate with the CBN to ensure its success.

Highpoint of the ceremony was the presentation of symbolic cheques to the beneficiaries, through seven Participating Financial Institutions (PFIs) – FCMB, Fidelity, Keystone, Stanbic IBTC, Union Bank, Wema Bank and Zenith Bank.