Why Vehicle Financing Scheme Is Not Working In Nigeria– Innoson

Vehicle financing is a major issue in Africa’s biggest economy and the country’s largest indigenous manufacturer is not willing to give out vehicles without guarantee from employers and banks.

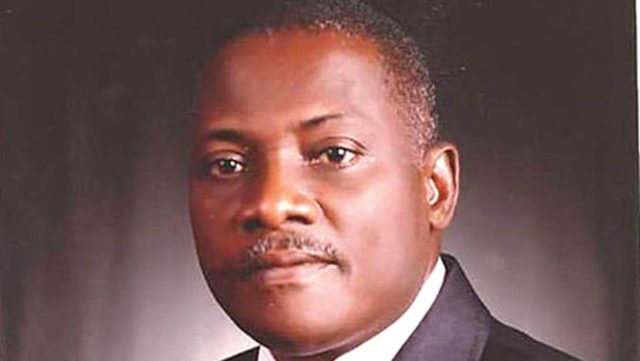

The Chairman of Innoson Group, Innocent Chukwuma, disclosed on Thursday that he is not willing to risk giving his cars to Nigerians without proper financing plan.

Chukwuma is the brain behind the car brand, Innoson Vehicle Motor better known as ‘IVM’.

Chukwuma told Arise TV that Nigerians who can not make outright purchase can enjoy his cars if things are allowed to work perfectly.

He said, “Those who have a good work, if the organisation they are working for assures us of our money, within three to four years, we are ready to give the vehicle.

“But most time, their organisation is not ready to sign for them. In South Africa, their organisation or their banks sign for them. So I cannot give anybody vehicle to pay monthly when their is no guarantee behind it.

“But if the organisation the person is working for can write to me, I can release the vehicle for the person to pay within four years.”

He said the organisation or bank involved in the agreement will guarantee monthly payment to IVM for three to four years.

Banks like First Bank of Nigeria offer car loans at 22 per cent interest, while the likes of First City Monument Bank charge 20 per cent interest with an equity contribution of 30 per cent of the car price.

But off takers have lamented that the rigors of getting the facility is frustrating.

The Nigerian government sometime in March 2019 announced a vehicle financing scheme for made in Nigeria cars, a policy which was not effectively implemented.

The government reached an agreement with three bank to give loans to eligible Nigerians after they must have deposited 10 per cent of the cost of the vehicle.

In February 2021, the Federal Government also said under the National Automotive Industry Development Plan (NAIDP), it will guarantee acquisition of cars for Nigerians with sustainable income.

The Director-General of the NADDC, Mr Jelani Aliyu, said the agency is “working on a Vehicle Finance Scheme that will enable Nigerians to easily own and drive these technologically advanced brand new cars.

“We have reached an advanced stage of discussion with some commercial banks, and as soon as we receive the necessary approvals, we shall deploy the programme.

“We have a worked out proposal in front of our superiors and once they give us that go ahead, we will start the project because we have the money set aside for it.

“The targeted beneficiaries will be any Nigerian who can prove that they have a sustainable income, whether you work in the civil service, in the private sector or you are doing your own business.”

(The Whistler)