Oil Price Recommendation for MTEF/DSP 2026-2028

By Chris UWADOKA

Nigeria’s economy is heavily reliant on crude oil revenues, which account for over 80% of export earnings and a significant portion of Federal Government income. The Federal Government of Nigeria (FGN) uses an oil price benchmark in its annual budgets, Medium-Term Expenditure Frameworks (MTEF) and Fiscal Strategy Paper (FSP) to project revenues and guide fiscal planning, in line with the Fiscal Responsibility Act. This benchmark represents an estimate of the average crude oil price (typically Brent or Bonny Light) for the budget year, often set below market forecasts to mitigate risks of shortfalls. However, historical data from 2011 to 2024 reveals persistent variances between these projections and actual average prices, leading to fiscal imbalances.

This work draws on the European Central Bank’s Working Paper No. 1735 (September 2014) by Cristiana Manescu and Ine Van Robays, which analyzes Brent oil price forecasting and addresses time-variation in model performance. Combined with data from Nigeria’s budget documents, it examines these variances, highlights the dangers of poor projections, and proposes methodological changes for the upcoming MTEF and Fiscal Strategy Paper (FSP) for 2025-2027. Finally, using time series analysis of 2011-2024 data, it offers an educated guess for the FGN’s likely 2025-2027 oil price projections.

Historical Variances: Projections vs. Actuals

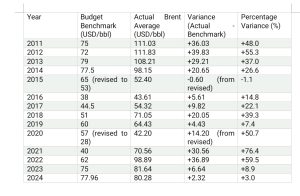

The FGN’s oil benchmarks are typically set conservatively, often 20-40% below prevailing market prices at the time of budgeting, to create a buffer against volatility. However, global oil markets are influenced by geopolitical events, supply disruptions, demand shifts, and speculative trading, leading to significant deviations. The table below compiles benchmarks from Nigeria’s budget documents (initial assumptions where revisions occurred) and actual annual average Brent crude prices (in USD per barrel). Data is sourced from budget analyses, government reports, and market databases.

Key Observations:

Underestimation Dominates: In 12 out of 14 years, actual prices exceeded benchmarks, with an average variance of +19.7 USD/bbl (or +34.2%). This reflects conservative forecasting, particularly during high-price periods (e.g., 2011-2014 post-global financial crisis recovery) and post-pandemic rebounds (2021-2022).

Overestimation in Low-Price Years: Rare overestimations occurred in volatile downturns, such as 2015 (oil glut) and initially in 2020 (COVID-19), leading to revisions and deficits.

Trends in Variance: Variances were largest during boom periods (e.g., +55.3% in 2012), shrinking in recent years as benchmarks aligned closer to market forecasts (e.g., +3.0% in 2024). This suggests improving conservatism but persistent exposure to upside surprises.

These variances stem from the FGN’s reliance on simple averaging of historical prices, stakeholder consultations (e.g., NNPC), and international forecasts (e.g., OPEC, EIA), without robust modeling for time-varying market dynamics.

Dangers of Poor Projections

Inaccurate oil price projections amplify Nigeria’s fiscal vulnerabilities, given oil’s dominance in revenues. The ECB paper underscores how oil price forecast errors vary over time due to structural shifts (e.g., shale oil boom, geopolitical tensions), a challenge mirrored in Nigeria’s experience. Overestimation (e.g., 2015, 2020) leads to revenue shortfalls, forcing borrowing or spending cuts. Underestimation, on the other hand, creates windfall revenues (e.g., +$36/bbl in 2022). Sudden surpluses distort resource allocation, while shortfalls delay infrastructure projects, perpetuating poverty (affecting 40% of Nigerians). Overall, these dangers compound Nigeria’s challenges: eg, stalled growth (averaging 3.4% annually vs. needed 7% for poverty reduction).

A salutary provision in Nigeria’s Fiscal Responsibility Act (Section 35) created and established a framework for managing an Excess Crude Account (ECA) whose purpose is to delink the FGN’s budget performance from shocks in the global market for oil and gas. Upon the enactment of Act in 2007, State Governments raised strong objection to the idea of an Excess Crude Account (ECA) that mandates savings of revenue due the three tiers of government from the Federation Account. They requested the FGN to adhere to the provision of Section 162 of the 1999 Constitution of the Federal Republic of Nigeria (1999CFRN) which requires all revenue inflows into the Federation Account to be shared. The State Governors stated that they ought to be allowed to save their own shares of the Federation Account inflows if, and in the manner, they may choose. The issue was eventually settled between the parties. The ECA subsists; but the jury is out on whether its application demonstrates the saving power that was intentioned by the crafters of the FRA.

Proposed Change in Projection Method

As the FGN prepares the 2025-2027 MTEF/FSP, it should shift to a dynamic, model-based approach inspired by the ECB paper. The paper highlights time-variation in forecast performance – individual models (e.g., random walk, futures) excel in certain periods but fail in others due to regime shifts (e.g., stable vs. trending prices).

Recommended Method: Forecast Combination Approach

Core Proposal: Adopt an equal-weighted combination of four models, as proposed in the ECB paper: (1) Futures prices (market-based), (2) Risk-adjusted futures (accounting for time-varying risk premiums via indicators like global capacity utilization), (3) Bayesian Vector Autoregression (BVAR) incorporating global activity, oil supply, and demand, and (4) Dynamic Stochastic General Equilibrium (DSGE) model simulating oil market structures.

Why This Works: The ECB study shows this combination reduces mean squared prediction errors (MSPE) by up to 30% vs. benchmarks, minimizes bias, and improves directional accuracy (success ratio >0.5). It addresses time-variation by averaging diverse methods, ensuring robustness across horizons (1-11 quarters, suitable for MTEF’s 3-year span).

Adaptation for Nigeria: The following local adaptations are proposed:

Integrate local factors (e.g., Niger Delta insecurity, theft impacting production) into BVAR/DSGE via real-time data from NNPC and CBN.

Use ensemble weighting (e.g., inverse MSPE for recent performance) to adapt to Nigeria’s volatility.

Consult multiple sources (World Bank, IMF, EIA, Goldman Sachs) as inputs, but combine via models rather than ad-hoc averaging.

Implement via a dedicated forecasting unit in the Budget Office, with annual back-testing against actuals.

This change would yield more accurate benchmarks (e.g., reducing average variance by 15-20%), enabling better revenue planning and fiscal stability.

Educated Guess for 2025-2027 Projections

Using 2011-2024 time series, we analyze patterns: benchmarks average $58.5/bbl (vs. actual $75.5/bbl), with a mean underestimation of $17/bbl. They correlate with lagged actuals (r=0.65), often set at 75-85% of the prior year’s price or international forecasts (e.g., 2024’s $78 aligned with EIA’s $78 projection).

For 2025-2027:

Current context (Aug 2025): Brent YTD $71.35, current ~$68, amid global slowdowns.

Time series trend: Linear regression of benchmarks yields ~$70 for 2025, rising modestly.

Incorporating forecasts (e.g., World Bank $84, IMF $67, EIA $78 for 2025): Average ~$75.

FGN’s conservatism: Likely 10-15% below forecasts to buffer deficits.

Educated guess: $70-75/bbl for 2025 (central $72), $68-73 for 2026, $65-70 for 2027, assuming no major shocks. This aligns with historical caution and current low prices, but adopting the proposed method could refine it to $75+ if models signal upside.

Chris Uwadoka is an Abuja-based Economist;

chrisuwadoka@hotmail.com

https://www.linkedin.com/in/christian-uwadoka-b2774322