Nigerian Govt unfolds plans to cut down on cost of Tax Expenditure, ensure Tax Incentives

Oru Leonard

The Federal Government of Nigeria has revealed plans to ultimately cut down on the cost of tax expenditure and ensure tax incentives which would positively impact the economy.

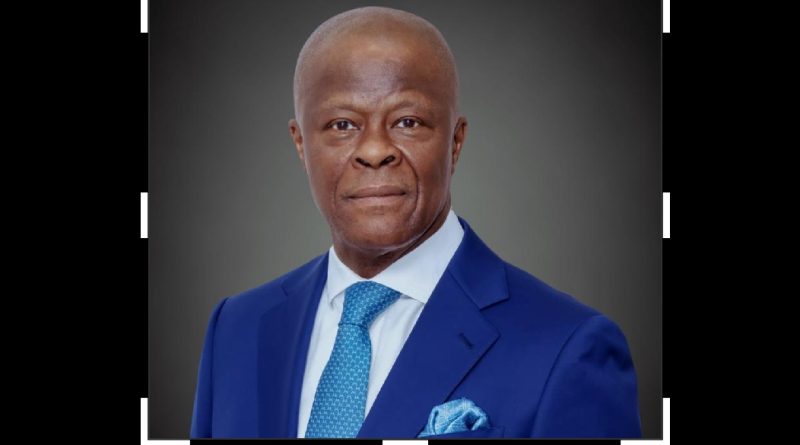

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, recently approved the inclusion of an Incentive Monitoring and Evaluation Platform (IMEP) in the current Import Duty Exemption Certificate (IDEC) process.

The IDEC automation, which was introduced as from 1st March, 2020, is a Fiscal incentive by the federal government under the Ministry of Finance to boost sectors of the economy by exempting critical players from paying import duty and all other statutory customs charges respectively.

According to him: “This is to provide the Federal Ministry of Finance with a robust automated tool for more effective Monitoring and Evaluation (M &E), measurement of the impact of all customs duty exemptions issued by the Ministry to government entities, companies, non- governmental oganisations (NGOs) and international organisations.”

The Minister explained that the system is designed to provide a framework to exclude and restrict ineligible applicants, enforce strict compliance to fiscal policy measures and provide a robust impact analysis of tax incentives on the economy. “This will further eliminate the misuse of tax expenditures; support the delivery of economic outcomes from fiscal incentives and strengthen the direct measurement of the impact of tax incentives on the economy”, he added.

He listed the key features of the IMEP to comprise: duty waiver claw back mechanism for issuance of demand notices to defaulters which would prevent misuse of issued incentive, e-report generation, a centralised database, factory geo-location tagging, industry qualification status validation, and inter- ministries department and agency (MDA) integration.

Mr Edun stated further that a webinar would be conducted on Tuesday, 23 April 2024, to provide clarity on the revised IDEC process.

He therefore called on all key industry stakeholders, including manufacturers, importers, MDAs, NGOs to attend, stating that the link for the webinar would be published on the Ministry of Finance website, and on the IDEC’s YouTube channel.

(FMoF Press)