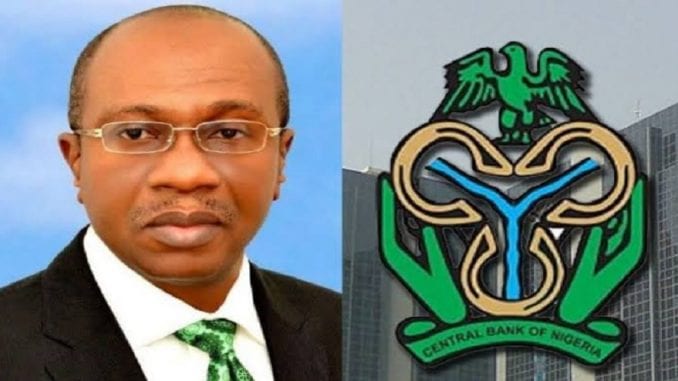

CBN To Stop Customers On Watchlist From Using Banks, Accessing Loans

Oru Leonard

Individuals on the Central Bank of Nigeria’s (CBN), blacklist may be prevented from creating new relationships with any participant (banks) or obtaining loans, according to the CBN.

Mr. Musa Jimoh, Director, Payments System Management Department, signed the CBN’s Revised Regulatory Framework for Bank Verification Number (BVN) operations and Watch-List for the Nigerian Banking Industry.

As part of its broader strategy for fostering a secure and efficient banking and payments system, the CBN said the framework will improve the efficacy of customer due diligence and Know Your Customer (KYC) operations.

What the CBN is saying

In the paper, Mr. Jimoh noted that individuals who misuse personal and financial information, commit identity theft, or violate confidentiality will face harsh penalties under the new legislation.

The framework states that if a financial institution chooses to continue an existing business relationship with holders of accounts/wallets on the watch-list, the account holder will be prohibited from using all electronic channels, including but not limited to ATM, POS, Internet Banking, Mobile Banking, and USSD, including the issuing of a new card.

The new framework also states that a customer with a watch-listed BVN may not reference accounts, gain access to credit facilities, or guarantee credit facilities; as a result, customer breaches such as the use of false papers, forgery, compromise, complicity, and connivance may persist.

Receipts of proceeds of deception, deception, receipts of fraudulent funds, and any other violation of AML/CFT regulations, as well as dishonest behavior, are all significant offenses.

The CBN, on the other hand, stated that it will continue to monitor industry developments and give such instructions as needed in the near future