CBN raises alarm over rising debt level,cautions FG

The Monetary Policy Committee of the Central Bank of Nigeria on Tuesday cautioned the Federal Government against the rising debt level in the country.

The committee warned that except the Federal Government came up with measures to address the country’s debt level, Nigeria’s debt burden might rise up to the pre-2005 Paris Club level.

In October 2005, Nigeria and the Paris Club announced a final agreement for debt relief worth $18bn and an overall reduction of Nigeria’s debt stock by $30bn. The deal was completed on April 21, 2006, when Nigeria made its final payment and its books were cleared of any Paris Club debt.

Based on statistics released by the Debt Management Office, Nigeria’s debt profile as of June 30, 2018, was $22.08bn.

Key government officials in the Economic Management Team had on many occasions in the past defended the country’s debt level arguing that it was still sustainable.

For instance the Vice-President, Yemi Osinbajo had last week when asked if Nigerians should worry about the country’s debt status, said that the country was not in any form of danger.

He had said, “Every country in the world that wants to make progress borrows money and our debt to GDP is one of the lowest in the world.

“What we are spending on is infrastructure. We took the borrowings that are for infrastructure.

“We are not in any kind of danger because we are borrowing for the right thing.”

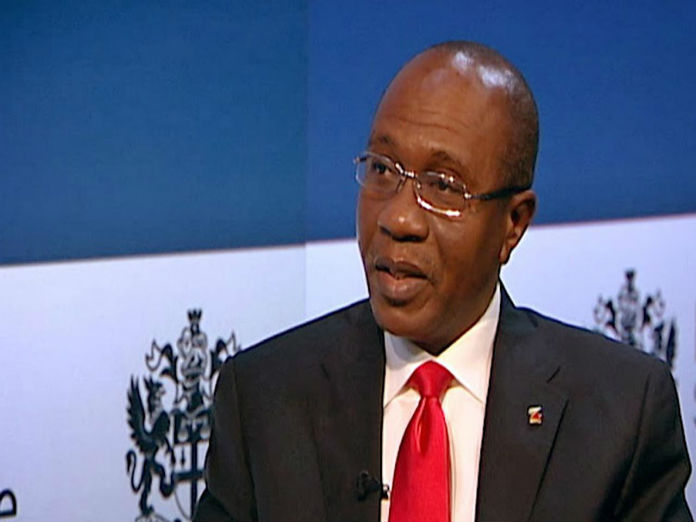

Addressing journalists shortly after the two-day MPC meeting held at the headquarters of the CBN, the apex bank’s Governor, Mr Godwin Emefiele, said that the committee noted the rising debt profile and called for caution.

He said, “On external borrowing, the committee noted the increase in debt level advising for caution, noting that it could fast be approaching the pre-2005 Paris Club level.”

Emefiele said the committee noted that while the real Gross Domestic Product grew by 1.81 per cent during the third quarter of 2018, the persistence of herdsmen attacks on farmers, cattle rustling and flooding in parts of the country affected agricultural and livestock output.

The governor said in view of this, the output for growth remained fragile as the late implementation of the 2018 budget and the residual impact of flooding and security challenges constituted headwinds to growth.

To address the fragile economic outlook, the governor said the committee was of the view that effective implementation of the 2018 capital budget and the Economic Recovery and Growth Plan would stimulate economic activities.

He also added that there was a need for improvements in the security situation in the country as well as continued stability in the foreign exchange market to enhance aggregate demand and growth.

He said, “The committee observed that the near term risk to inflation remain the impact of flooding on agricultural output, insecurity on food producing belts in the country, exchange rate pass through to inflation due to the weakening of oil price and campaign-related spending towards the 2019 general elections.

“Accordingly, the Monetary Policy Committee called on the Federal Government to sustain its efforts towards improving security to ease supply chain bottlenecks.

“The committee recommended that the Federal Government should focus investment on infrastructure and urge the Federal Government to sustain the pace towards addressing infrastructure deficit in Nigeria.

“It noted that the immediate impact of this on the GDP will be slow in coming but it will expand the economy, reduce unemployment and increase aggregate demand in a more sustainable manner.”

On the plan by the Federal Government to raise more revenue through Value Added Tax, the CBN governor said the committee was in support of the move as it would help to reduce pressure on government expenditure.

“The committee also noted the attempts by the government to broaden the base of the Value Added Tax and urge the authorities to expedite action in that effect, arguing that increased tax collection will reduce pressure on government expenditure and create fiscal buffers to improve macroeconomic management,” he added.

On the recent increase in foreign capital inflow into the country despite the political risks, Emefiele said this was based on the confidence of the international community in the country’s macroeconomic management.

He said, “The observed and recent high foreign capital inflow into the Nigerian economy despite the perception of political risks is based on the confidence of the international community in the country’s macroeconomic management and provides a compelling reason for the committee to await clarity on the macroeconomic performance after the general elections in February and March.”

On the Monetary Policy Rate, he explained that the 11 members of the committee that attended the meeting agreed to retain all the monetary policy parameters.

This, he added, implied that the MPR was left unchanged at 14 per cent, while the Cash Reserves Ratio was retained at 22.5 per cent.

Also retained were the Liquidity Ratio which was left at 30 per cent and the Asymmetric Window which was left at +200 and -500 basis points around the MPR.