CBN Promises to Sustain Stability In the Forex Market

..as Nigeria’s Monthly Import Bill Drops from $665.4m to $160.4m

By Oru Leonard

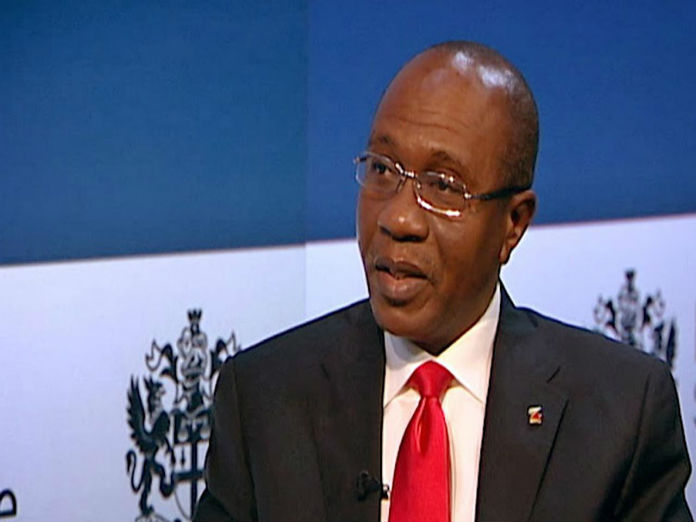

The Governor of Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, has said that Nigeria’s monthly import bill falling significantly from $665.4 million in January 2015, to $160.4 million as at October 2018, representing a drop by 75.9 per cent and an implied savings of over US$21 billion on food imports alone over that period.

He noted that the various initiatives aimed at encouraging domestic production, had resulted in the fall of the import.

Mr Emefiele disclosed this in a keynote address he delivered at the 53rd Annual Bankers’ Dinner of the Chartered Institute of Bankers (CIBN) held in Lagos.

He said that many entrepreneurs are now taking advantage of policies aimed at ramping local production to venture into the domestic production of the restricted items with remarkable successes and great positive impact on employment.

“The dramatic decline in our import bill and the increase in domestic production of these items attest to the efficacy of this policy.

“Most evident were the 97.3 percent cumulative reduction in monthly rice import bills, 99.6 percent in fish, 81.3 percent in milk, 63.7 per cent in sugar, and 60.5 percent in wheat.

“We are glad with the accomplishments recorded so far. Accordingly, this policy is expected to continue with vigour until the underlying imbalances within the Nigerian economy have been fully resolved.

“If we continue to support the growth of small holder farmers, as well as help to revive palm oil refineries, rice mills, cassava and tomato processing factories, you can only imagine the amount of wealth and jobs that will be created in the country.

“These could include new set of small holders farmers that will be engaged in productive activities; new logistics companies that will transport raw materials to factories, and finished goods to the market; new storage centres that will be built to store locally produced goods; additional growth for our banks and financial institutions as they will be able to provide financial services to support these new businesses; and finally, the millions of Nigerians that will be employed in factories to support processing of goods.

“If we turn a blind eye to the opportunities that are being created as a result of our policy on 41 items, we will be spelling doom for our nation. We can no longer afford to depend solely on imports given the size of our population, and the need to create jobs for our people.”

The CBN governor also stated that the bank would be collaborating with the Economic and Financial Crimes Commission (EFCC) to expose banks, importers or organisations that collude with corrupt individuals to flout its policy on the restriction of foreign exchange (forex) to 41 items.

The CBN had in July 2015, restricted 41 items, including vegetable oil, poultry products, toothpicks, cosmetics, plastic and rubber products, among others, from accessing foreign exchange from the interbank foreign exchange market.

Importers of the restricted items were asked to source their forex requirements from autonomous sources.

Emefiele pointed out that given the remarkable success that had been achieved in stimulating domestic production of goods such as rice, cassava and maize, as a result of the restrictions placed on access to forex for the 41 items, the central bank intends to vigorously ensure that the policy remains in place.

He also warned speculators in the forex market that they would lose their shirt, saying the central bank has enough war chest to sustain the stability in the forex market.

According to him, the central bank would continue to take measures to ensure stability in the forex market.

He told the CIBN participants that additional efforts would be made to block any attempts by individuals and corporates bodies that intend to find other avenues of accessing forex, in order to import these items into Nigeria.