NDIC Reassures Nigerians of Bank Deposit Safety at Abuja Trade Fair

Oru Leonard

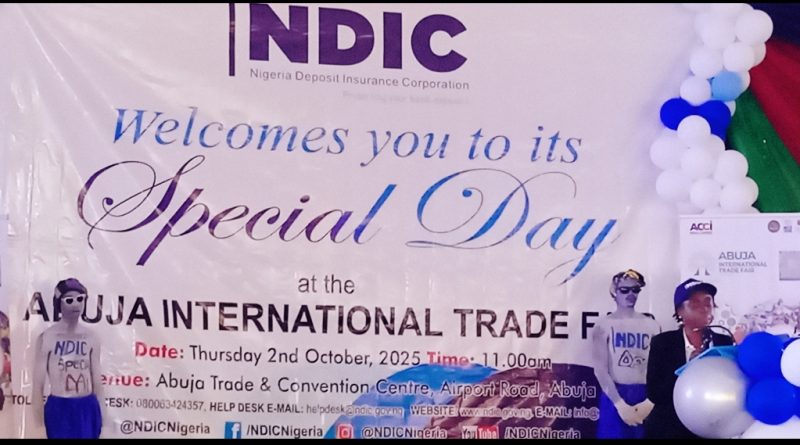

The Managing Director/Chief Executive of the Nigeria Deposit Insurance Corporation (NDIC), Mr. Thompson Oludare Sunday, has reiterated the corporation’s commitment to protecting depositors’ funds and maintaining stability in the banking sector. Speaking at the NDIC’s Special Day at the 20th Abuja International Trade Fair, Sunday emphasized the importance of vigilance against Ponzi schemes and fraudulent investment platforms.

“We are dedicated to protecting Nigerians’ bank deposits and promoting financial inclusion and stability by reassuring Nigerians of the security of their savings”, the MD/CEO, NDIC stated.

Represented by the Director of Performance Management, Mrs Olaienpe Akande, he disclosed the following that the NDIC insures depositors of Deposit Money Banks (DMBs) up to ₦5 million and depositors of Payment Service Banks (PSBs), Microfinance Banks (MFBs), and Primary Mortgage Banks (PMBs) up to ₦2 million.

The NDIC has paid out insured deposits to depositors of failed banks, such as Heritage Bank, and continues to make liquidation dividend payments to depositors with sums exceeding the insured limit.

The NDIC works closely with the Central Bank of Nigeria (CBN), to maintain stability in the banking sector and enforce compliance with banking regulations.

Speaking, the Director-General of the Abuja Chamber of Commerce and Industry (ACCI), Mr. Agabaidu Jideani, praised the Nigeria Deposit Insurance Corporation (NDIC), for its role in maintaining financial system stability and promoting confidence in the banking sector.

Speaking at the NDIC’s Special Day at the 20th Abuja International Trade Fair, Jideani highlighted the importance of the corporation’s mandate in protecting depositors and supporting economic growth.

“By working together, we can build stronger linkages between financial safety, enterprise growth, and national development”, the DG, ACCI concluded

According to him the NDIC and ACCI have a long-standing partnership aimed at strengthening Nigeria’s financial system stability and promoting economic growth.

He further noted that the NDIC’s initiatives in advancing financial inclusion, particularly through digital innovations and consumer protection frameworks, have created a more enabling environment for SMEs and entrepreneurs. The NDIC’s deposit insurance scheme provides a safety net for depositors, contributing to financial system stability and confidence in the banking sector.