Cardoso’s CBN, If It Must Be?

Ademola Oyetunji

The outgoing year of 2023 has been characterized by mixed sentiments for the Nigerian economy, particularly within the financial sector.

The year commenced with the aftermath of the economic disruption caused by the currency redesign, leading to economic uncertainty and the closure of numerous businesses. Additionally, unexpected deaths occurred in various parts of the country, accompanied by heightened political tension due to the general election amid Naira scarcity.

Unfortunately, the Naira redesign exercise was poorly managed, resulting in considerable hardship.

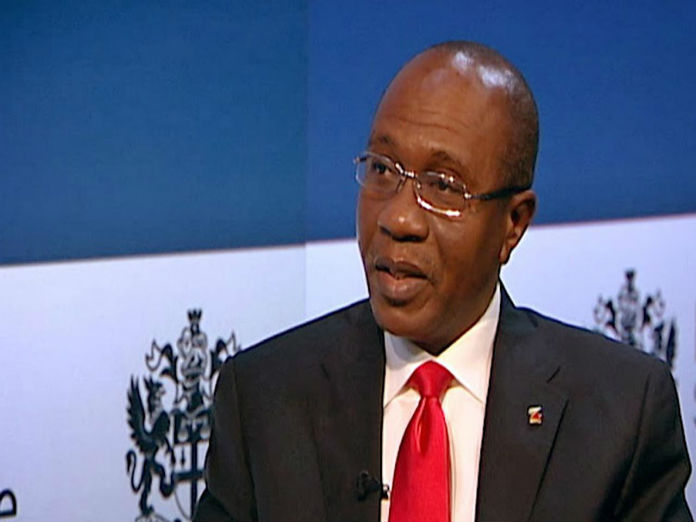

The Central Bank of Nigeria was also enmeshed in the political web as the then-former Governor, Godwin Emefiele, made an audacious foray into politics. For this misadventure, his monetary policy initiatives were assumed to be politically tainted, particularly the Naira redesign initiative on the eve of the 2023 general elections, believed to road blocked some politicians in retaliation for his aborted political ambition. The rest is now history.

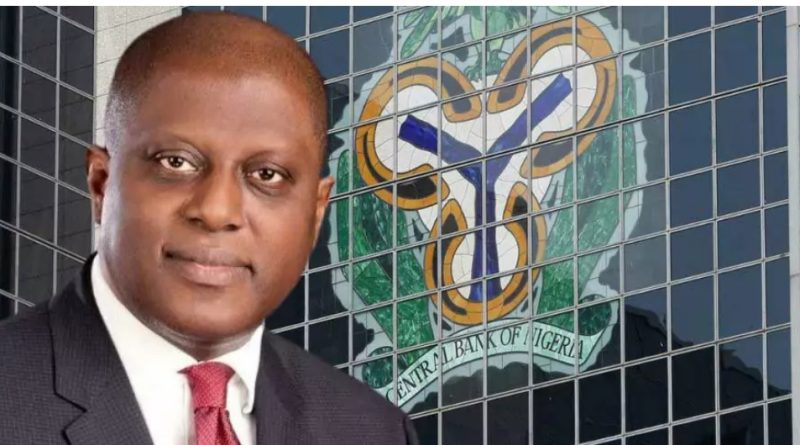

However, irreparable damage had been done to the integrity of the CBN. Nigerians lost confidence in the institution. Their deposits in commercial banks were considered confiscated as they could not access their money. To date the Bank is still grappling with a trust deficit problem which the new management headed by Mr. Olayemi Cardoso is struggling hard to restore.

It was thus an auspicious occasion at the annual CIBN conference for Mr. Cardoso to unveil his healing mission of the damaged integrity of the CBN and the financial sector. He leveraged the occasion to explain his activities and his mission. The annual conference is a traditional forum for every CBN governor, past and present, to hobnob with financial sector technocrats and to forecast economic growth for a new financial year. His presence at the August forum was soothing to Nigerians and global financial net worth.

A soothing balm because past activities at the Bank, particularly, the controversial tenure of its immediate past helmsman, the economic uncertainties, the high inflation rate, the free-falling of the Naira, corporate governance encumbrances, among other issues under Emefiele’s CBN made Nigerians lose faith in the ability of the Bank to effectively manage the economy.

The Bank interloped into areas it has no competence and abandoned its own mandate. And what was never experienced in global central banking reared its head in Nigeria. A sitting apex bank governor became political and attempted to seek the highest political office in the country. Nigerians and the international community were wowed by his audacity.

A veritable forum for Cardoso to share perspectives on burning issues affecting the banking and financial services sector, particularly, the economy, and avail the industry giants an opportunity into the mind of the regulator concerning the economy in its bid to reshape the macroeconomic outlook, in short to medium term. The Governor was blunt about the economic challenges facing the economy. These are internal and external factors.

The intractable insecurity in some regions of the country has affected the major food belt region causing food inflation. The Russian-Ukraine war, and lately, the Israel-Hamas war. Crude oil, Nigeria’s main revenue receipt is challenged, and surprisingly, the non-oil sector continues to be a dominant driver of growth. Agriculture, services, and industrial sectors contributed 1.94%, 4.20%, and 1.50% respectively in Q2 2023 with an expectant growth rate of 2.36% in the third quarter and an anticipated 3.97% increase in the fourth quarter. The economy, he said, is also challenged infrastructurally thereby encumbering its fortunes.

Currently, the economy is facing high and rising inflation last witnessed almost two decades ago, inadequate forex inflow, Naira exchange rate depreciation which has posed a huge risk to domestic banks with foreign exchange exposure, depleting foreign reserves, weakened output, and embarrassingly, high unemployment rates, almost 37%. The Naira drastically depreciated immediately after the reunification of the exchange rate by the President. Currently, Naira at the Investors and Exporters (I & E) window exchanges at N887/$1, while at the parallel market where huge demand is settled, the domestic currency exchanges at N1,250/$1. The Naira is facing the worst challenge in history.

What had been agitating Nigerians was quickly allayed when he told his audience that Nigerian banks are sound and healthy. He said there is room to further strengthen and enhance their resilience to shocks and hinted that the government has commenced fiscal reforms to position the economy for a $ 1 trillion economy in 7 years. The CBN Governor said it is therefore expedient to also position the banking sector for President Tinubu’s envisioned bigger economy. This means there would be another round of recapitalization and merger witnessed under Charles Soludo led CBN. Ever since the Governor announced his intention there have been hushed and panic discussions among stakeholders despite giving the banking sector a healthy verdict.

Worrisome though is the deliberate undermining of the regulator’s effort to reposition the financial sector for regulatory compliance while ensuring price stability to safeguard the livelihood of Nigerians. Efforts are also ongoing to stabilize the foreign exchange market. The Bank under Cardoso has undertaken stringent measures to rescue the Naira. Among these are the lifting of suspension on the 43 items, and trading in cryptocurrency in Nigeria, noting that trending global disposition necessitates the action. What the Bank needs to do is to strictly regulate it in tandem with global best practices. Recently, Mustapha Haruna, Director, Financial Policy Regulation, Central Bank of Nigeria, made this known to the public.

Speculators and some criminal elements are hell-bent to frustrate every effort of the Bank geared towards Naira regaining its value. Their activities have been disrupting effective planning and making informed business decisions difficult.

Culpable in this web of criminality are the commercial banks. They have been unsupportive of the regulator’s continuous strive to maintain price stability, and effective execution of its mandate. They have unwittingly been collaborating with economic saboteurs, thereby making ineffective CBN’s initiatives to have an undisruptive economy. It is high time the CBN began to wield the big stick if its efforts are to bear dividends. Economic parasites have taken the CBN for a ride too long, particularly under the immediate past dispensation at the bank.

A classical example was the DMB’s uncooperative attitude during the Naira redesign saga where customers were starved/restricted from their deposits. DMBs hoarded the new banknotes for their high-valued customer and were selling mint banknotes to currency sellers. They hobnobbed, giving free access to banknotes unavailable at the banking halls and ATMs to Point of Sale (PoS) operators for a price. Rather than owning up to their criminal activities that were obvious to the public, everyone accused the CBN of humiliating and dehumanizing them. The commercial banks undoubtedly contributed greatly to the disruption of the economy at the time, which it is yet to recover from.

To confirm their culpability in economic sabotage, shortly after Governor Cardoso’s speech at the CIBN, the banks emptied the ATMs, restricting genuine bank customers who need their monies to miserable N10,000:00 per withdrawal, yet primed customers walk in and come out with millions of Naira in stacked bags, and Nigerians are blaming the CBN.

On December 27, 2023, I was at the Guaranty Trust Bank (GTB) Central Area, Abuja office to resolve a failed transaction issue when a man in his mid-fifties walked in with a friend to the banking hall. He asked the cash officer (name withheld) from people at the counter and the guy showed up, respectfully saluting the man.

The customer then asked if the N10,000,000:00 cash was ready, and the cash officer answered in affirmative. Shockingly he added: “I got the cash ready yesterday”. Yesterday was December 26th, Boxing Day public holiday. Thereafter, and unashamedly, the man asked his friend how much exactly he wanted, and the friend replied: I need N9,500,000:00. Swiftly the money was arranged to the bewilderment of frustrated customers who had been told, even with a signpost on the wall notifying any customer that only N10,000:00 can be withdrawn as directed by the CBN. The man before he walked away told the bank official via a small paper he scribbled something on, to debit his domiciliary account for the transaction. Uninformed people will blame the CBN.

The banks are daily supplied with enough cash for even two days of transactions irrespective of the festive periods. What is currently playing out was the exact during the Naira redesign programme, deliberate effort to smear the CBN. For this brazen criminality and unethical behaviour to end, the CBN irrespective of whose horse is gird must make examples of people. The banks have once again in less than a year made Nigerians to suffer scarcity of banknotes, making the yuletide season an uninteresting and suffocating time.

As Cardoso and his team strive to rebuild the CBN and the financial sector, the issue of corporate governance failure prevalent in the financial sector must be addressed if the economy of his dream would be a reality, a CBN that would be a catalyst for economic stability and growth.

Ademola Oyetunji writes from Ibadan.

Photo Credit: Newsone.com